what is epf malaysia

This one is your retirement fund - with a huge bonus. The legal procedure after a persons death can be complex.

The Complete Employer S Guide To Epf Contributions In Malaysia Althr Blog

EPF refers to a social security institution under the Ministry of Finance Malaysia which manages a compulsory savings and retirement planning scheme for legally employed.

. You probably already know this but just in case you didnt EPF is essentially a retirement savings account for employees of the private and non-pensionable public sector. Commonly referred as Kumpulan Wang Simpanan Pekerja KWSP the Employees Provident Fund EPF is a social security institution in Malaysia. Both the employer and employee must make contributions to the fund every month.

The Malaysian EPF is a compulsory pension scheme for all Malaysians. EPF has set up an advisory panel to help Malaysians make smart financial decisions. Birth old age sickness and death these are the inevitable stages in human life.

Even though that rate sounds low bear in mind that for. The establishment of EPF serves the purpose to. The Employees Provident Fund EPF has warned.

EPF in Malaysia. While you have to contribute minimum of 9. Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly known as.

EPFKWSP - EPF stands for Employee Provident Fund Kumpulan Wang Simpanan Pekerja. Employers need to register with. A Government-guaranteed minimum rate of 25 will be paid out to each and every contribution to the EPF.

Formed in 1951 pursuant to. The Distribution of Insurance and EPF in Malaysia. The EPF provides for compulsory retirement savings and contributions for all Malaysian citizens and.

The EPF is a retirement planning scheme for employees in Malaysia. Based on the EPF Act 1991 EPF is essentially a form of social security for Malaysian employees and it functions as a mandatory pension plan for employees who dont have access to. The Employees Provident Fund EPF is governed by the EPF Act 1991 and functions as a mandatory pension scheme for Malaysian employees and Permanent Residents.

The Employees Provident Fund known by its acronym EPF or KWSP in Malay is a Malaysian government agency that manages a compulsory savings plan and retirement planning for. EPF also known as KWSP Employee Provident Fund or Kumpulan Wang Simpanan Pekerja is a Malaysia government statutory body under the category of Ministry of Finance. The Employees Provident Fund EPF is governed by the Employees Provident Fund Act 1991.

Best Payroll Sotware Malaysia What Is Subject To Epf Sql Payroll Hq

Employees Provident Fund Malaysia Wikipedia

Pdf Malaysia Pension Financial Market Reforms And Key Issues On Governance Semantic Scholar

Summary Of Case Study On Employee Provident Fund Of Malaysia

How To Withdraw Epf As An Ex Citizen Residing Outside Of Malaysia By Vern Chan Medium

How To Apply An Online Epf Account I Account On Kwsp Website Part 1 Mkyong Com

Over 5 3 Million Applied For Epf 2022 Special Withdrawal Amounting To Rm40 1 Billion World Of Buzz

4 Of Respondents In A Sun Life Malaysia Retirement Survey Says Epf Accounts No Longer Have Enough Amount To Withdraw The Edge Markets

Epf Buys Bursa Shares As Price Falls To Lowest In Three Months The Edge Markets

Rm18 1 Bil Withdrawn Under Epf S I Lestari Malaysia The Vibes

Epf Headquarters Stock Photos Free Royalty Free Stock Photos From Dreamstime

Finance Malaysia Blogspot How To Calculate Epf Investment Withdrawal Amount

Finance Malaysia Blogspot What Is Epf E Pengeluaran For Education April 2016

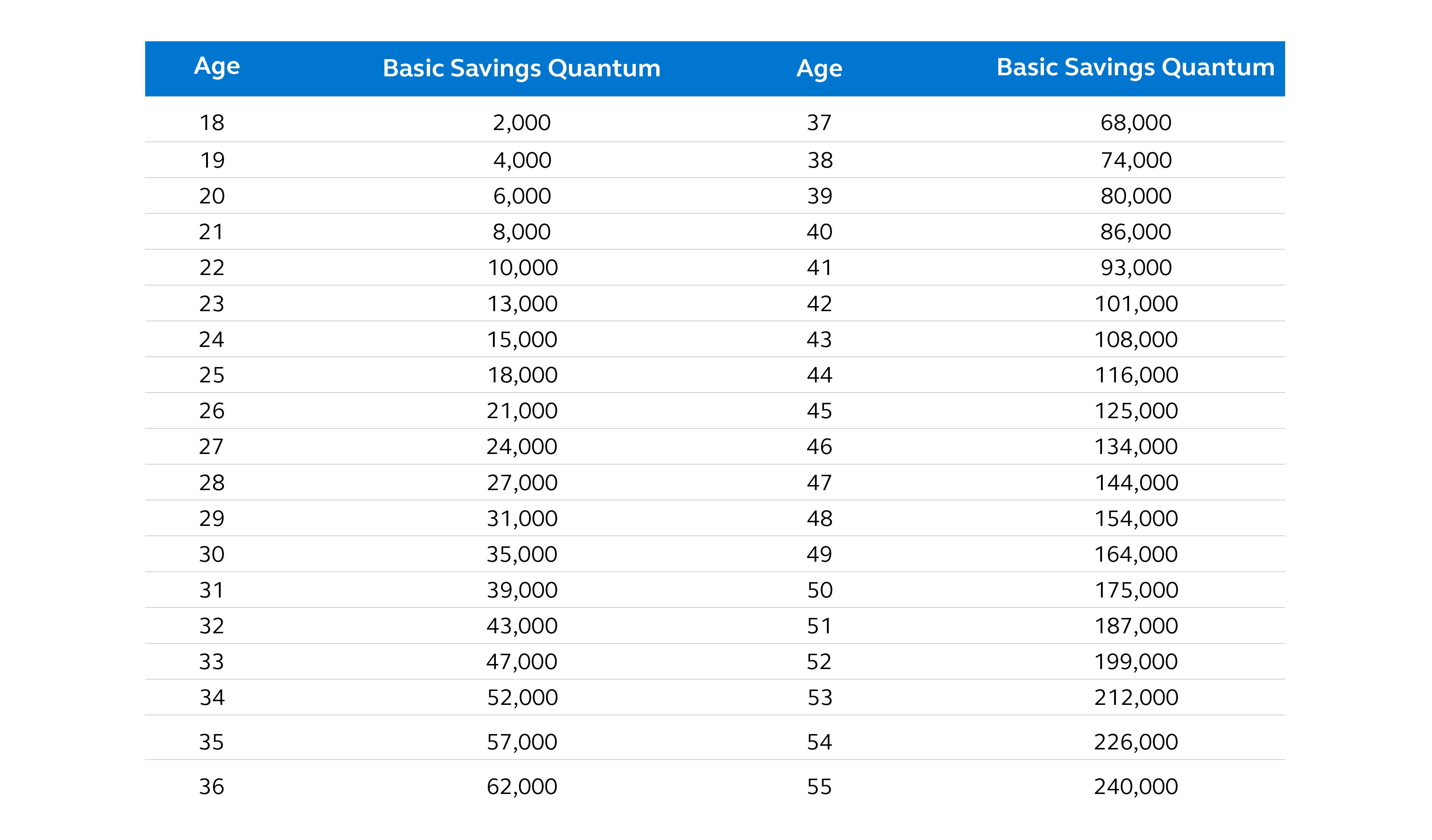

Finance Malaysia Blogspot Epf Mis Revised Basic Savings Table And Calculation Effective Jan 2017

Epf May Have To Sell Overseas Assets If Fourth Round Of Withdrawals Allowed R Malaysia

How Does Employee Provident Fund Epf Works In Malaysia Anc Group

What Is The Ideal Savings According To Age Bracket Principal Malaysia

Comments

Post a Comment